Canadian authorities appear to have taken a hands-off approach to an alleged case of foreign bribery of a Chinese government official on the part of a Vancouver-based energy company that trades on the Toronto Stock Exchange.

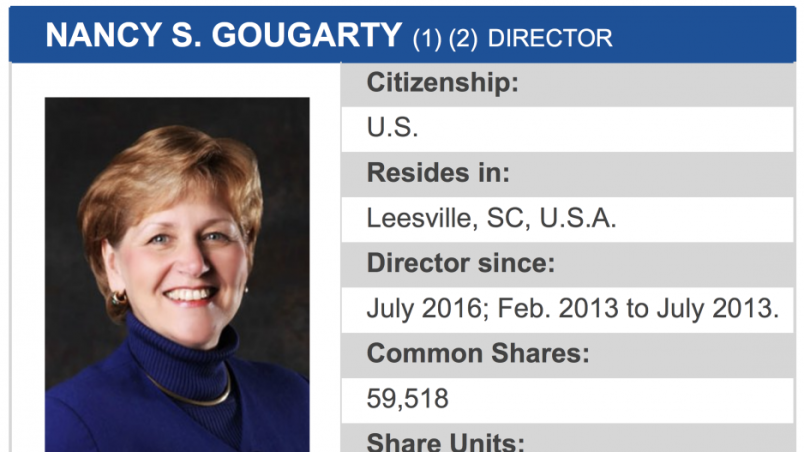

The RCMP has decided not to investigate and the B.C. Securities Commission (BCSC) will not comment on any potential civil enforcement action of its own in relation to whether Westport Fuel Systems Inc. chief executive officer Nancy Gougarty bribed a Chinese government official for her company’s financial gain, as outlined by a United States Securities and Exchange Commission (SEC) order.

Instead, the matter has been left to American authorities.

Both the RCMP and the BCSC declined interviews to explain in detail why no enforcement action has been taken, although the commission claims it lacks the legal mechanism to explicitly investigate foreign bribery by Canadian companies, unlike its American counterpart.

As such, the case highlights an enforcement gap for foreign bribery by Canadian companies, particularly those listed only on Canadian exchanges.

On September 27, the SEC issued an order against NASDAQ-traded Westport that outlined, as fact, how the company and Gougarty “engaged in a scheme to bribe a Chinese foreign government official to obtain business and a cash dividend payment from Westport’s Chinese joint venture.”

However, Westport and its now former CEO Gougarty, an American, made no admission or denial of the SEC order’s findings; instead, they agreed on a settlement that resulted in the company paying a $1.5 million civil penalty and disgorgement of $2.4 million, and Gougarty paying a $120,000 fine, for their collective involvement in the bribery scheme, according to the SEC order.

The joint venture’s largest shareholder was a Chinese state-owned entity led in part by the Chinese official who requested a discounted transfer of Westport’s JV shares to his private equity firm, according to the SEC order. The scheme took place with Westport aiming to improve its liquidity. The company has an accumulated deficit of $998 million and recorded a net loss of $31.5 million last year, 2019 audited statements show. Its shares are presently worth $3.10 each.

The SEC investigation looked into the alleged violations of the anti-bribery, books and records and internal controls provisions of the Foreign Corrupt Practices Act, which requires companies whose securities are listed in the U.S. to meet its accounting provisions. The SEC is tasked with enforcing those provisions under U.S. securities laws as an effort to protect the integrity of American capital markets.

But no such regulations exist in Canada, as the Corruption of Foreign Public Officials Act (CFPOA) provides no requirements for provincial regulators to ensure Canadian-listed companies follow its provisions. Hence, the BCSC is unable to engage in a civil action against a B.C.-based company for the explicit reason of not abiding by the CFPOA provisions.

“Neither the BCSC nor any other provincial securities regulator in Canada has the authority to investigate offences under that act, or to enforce it,” BCSC spokesperson Brian Kladko told Glacier Media.

This raises the fact that a Canadian company listed only on Canadian exchanges may only face criminal enforcement actions under CFPOA, which is administered by the RCMP.

As for Westport and Gougarty, “the matter has been investigated by the appropriate investigating agency in the U.S., namely the U.S. SEC, and a settlement reached,” said RCMP spokesperson Cpl. Caroline Duval. “The RCMP works in collaboration with domestic and international partners to ensure matters of public interest and safety are investigated.”

Duval declined an interview after Glacier Media noted Westport is a Canadian company that trades on the TSX (as well as the NASDAQ) for mostly Canadian investors. The company also has hundreds of Canadian employees.

This makes it unclear as to why the RCMP considers the U.S. the “appropriate jurisdiction,” especially given, as the SEC order notes, “the $3.5 million dividend was credited to Westport’s bank account in Vancouver, Canada, having been sent from a bank in China.”

Furthermore, while the BCSC has no authority to explicitly investigate foreign bribery under its own regulations, it could proceed with enforcement action in the absence of specific breaches of Canadian securities law by determining it is in the public interest to do so, as it has done in many instances.

The BCSC would not comment whether it could also investigate Gougarty for allegedly falsifying financial documents, as the SEC order outlined.

“To preserve the integrity of its investigations, the BCSC does not confirm or deny whether it is pursuing actions against companies or individuals that have been the subject of another regulator’s enforcement efforts,” stated Kladko by email.

BCSC director of enforcement Doug Muir declined to speak to the specifics of the case.

“When considering whether to take enforcement action, the BCSC’s primary goal is deterring future misconduct by the specific individuals and entities in question, and deterring others from engaging in similar misconduct,” said Kladko.

If the BCSC is not proceeding with any enforcement action against Westport, did it deem the SEC penalties as sufficient deterrence?

The SEC monetary penalties are as much as the company estimated it would have paid for any further legal fees, which by the time of the settlement totalled $18.1 million it already spent, net of insurance recoveries, according to company filings. Westport’s settlement also avoided “uncertain” outcomes, according to company documents prior to reaching a settlement. “Any final determination that the Company’s operations or activities are not, or were not, in compliance with the Foreign Corrupt Practices Act (FCPA) and/or other U.S. securities laws could result in significant civil and criminal financial penalties and other sanctions, which could have a material adverse impact on our financial condition.”

Furthermore, the company and Gougarty did not have to admit to the facts set out in the SEC order, although they also did not deny them.

As for Gougarty, she paid a $120,000 penalty with no admission of wrongdoing after voluntarily resigning from the company on January 14, with a significant retirement agreement of 1.74 million shares (valued at $2.3 million at the time), $585,000 cash and $106,250 vacation pay, company records show.

Many Canadians may have recently become familiar with foreign bribery enforcement with the so-called SNC-Lavalin affair thrust into the spotlight. On Sunday, former SNC-Lavalin executive vice-president Sami Bebawi was found guilty on all counts at his fraud and corruption trial, as reported by the Montreal Gazette.

Prosecutor Richard Roy told the Gazette the case “is another example of Canada’s commitment to fighting corruption of public officials and implementing its obligations under international conventions to fight corruption in international business.”

Alexandra Wrage, president of TRACE International, an anti-bribery organization, said, via email, the decision not to pursue Westport and Gougarty in Canada may come down to resources. This is because the SEC findings “are not binding on any other person or entity in this or any other proceeding” and the RCMP or BCSC would need to open a new investigation of their own – although they’d presumably have a head start with the SEC case, for which the BCSC provided assistance to American authorities.

“It’s a longstanding concern the RCMP has no dedicated resources for anti-bribery efforts,” she said.

Furthermore, Wrage calls the FCPA “something of an outlier” in its grant of “civil regulatory authority” to the SEC over foreign bribery matters.

“Most countries treat foreign bribery as a strictly criminal offense,” Wrage said. “The SEC's civil jurisdiction over foreign bribery cases is largely an artefact of one of the FCPA's original motivations: protecting shareholders by prohibiting the use of unaccounted-for slush funds in the payment of bribes.”

Such civil recourse also allows the U.S. Department of Justice some leeway when it declines to prosecute criminally, particularly in cases when the company cooperates or self-reports the incident, notes TRACE.

Wrage acknowledges that “other considerations come into play” with cross-listed companies. Under Article 4.3 of the OECD Anti-Bribery Convention, when more than one country has jurisdiction to prosecute a foreign bribery case, as in the case of Westport and Gougarty, they are to “consult with a view to determining the most appropriate jurisdiction for prosecution.”

In the case of Westport and Gougarty, the U.S. Department of Justice does not appear to have been involved, TRACE noted.

Wrage said, “It does not seem unreasonable in principle that a jurisdiction with limited resources would agree to having a better-resourced country take the lead in such a matter.”

In the case of Westport, Wrage said, "There may be other applicable provisions in Canadian securities or corporate liability law, but as far as Canadian anti-bribery law goes, it seems either that there may not be sufficient grounds for criminal prosecution, or prosecutorial discretion has led the RCMP to decline to bring a criminal case.”

The SEC order against Westport and Gougarty appears to have been significant, given the stated costs incurred by the company.

Securities law expert Poonam Puri of Osgoode Hall Law School of York University has written about cross-jurisdiction securities enforcement and warns about the perils of leaving investigations to other jurisdictions.

“Practically speaking, cross-listed companies are subject to the rules and regulations of both Canada and the United States, with possible enforcement oversight by both the U.S. Securities and Exchange Commission (“SEC”) and Canadian securities regulators,” stated Pooni in a Brooklyn Journal of International Law article.

“Indeed, some suggest that Canada should maintain its focus on Canadian-only companies and leave the oversight of enforcement activities for cross-listed issuers to the SEC.

“If this suggestion were followed, however, many of the larger issuers in Canada would be excluded from Canadian oversight, even though a significant number of their investors would likely be Canadian. From a policy perspective, the independence and autonomy of Canadian regulators would also be greatly undermined.”

Ermanno Pascutto, executive director of investor advocacy group FAIR Canada, said, “Canadian regulators should take the lead on companies that are primarily Canadian.”

Pascutto says civil recourse, as well as deferred prosecution, is important, as it may do more harm to investors if a company is prosecuted after its individual guilty parties are removed.

However, he said, the ultimate onus should be on the RCMP and the federal government.

“It makes a lot more sense for a federal government, through a national agency, to investigate in foreign countries than having a provincial commission show up.”

To that end, he expressed frustration Canada has no national securities regulator, and recent efforts to create one have been controversial.

In November, as mandated by the SEC, Westport updated its Anti-Corruption and Prevention of Bribery Principles policy. Westport is now under a two-year review period and must provide external auditors and the SEC with its updated internal audit plans.